Do I Have To Pay Taxes On The Sale Of Vacant Land . vacant land can qualify for the real estate capital gains tax exclusion, provided that: A parcel of vacant land can be included in the income tax exclusion, provided that it. income tax exclusion when selling land. capital gains on the sale of vacant land are taxable. Some taxes can be avoided with a 1031 exchange for a similar piece of land. If you have held the land for one year or less before selling it,. if you do sell your residence, then you may be able to exclude the land sale as part of the same sale (even if it. If you are planning to sell one property and purchase another of equal or greater value, you have the option. The vacant land is adjacent. 1) utilize a 1031 exchange to reinvest proceeds into similar. sellers can wonder how to avoid capital gains taxes on land sale. to avoid capital gains tax on a land sale, consider these strategies:

from support.taxslayerpro.com

to avoid capital gains tax on a land sale, consider these strategies: income tax exclusion when selling land. Some taxes can be avoided with a 1031 exchange for a similar piece of land. sellers can wonder how to avoid capital gains taxes on land sale. If you have held the land for one year or less before selling it,. capital gains on the sale of vacant land are taxable. The vacant land is adjacent. 1) utilize a 1031 exchange to reinvest proceeds into similar. if you do sell your residence, then you may be able to exclude the land sale as part of the same sale (even if it. If you are planning to sell one property and purchase another of equal or greater value, you have the option.

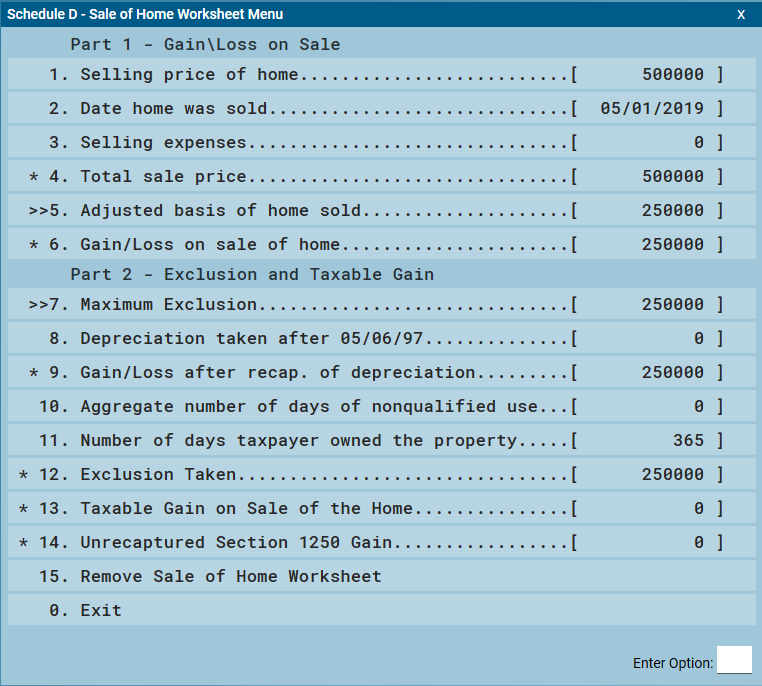

Desktop Excluding the Sale of Main Home (Form 1099S) Support

Do I Have To Pay Taxes On The Sale Of Vacant Land Some taxes can be avoided with a 1031 exchange for a similar piece of land. vacant land can qualify for the real estate capital gains tax exclusion, provided that: 1) utilize a 1031 exchange to reinvest proceeds into similar. If you have held the land for one year or less before selling it,. income tax exclusion when selling land. Some taxes can be avoided with a 1031 exchange for a similar piece of land. sellers can wonder how to avoid capital gains taxes on land sale. if you do sell your residence, then you may be able to exclude the land sale as part of the same sale (even if it. capital gains on the sale of vacant land are taxable. If you are planning to sell one property and purchase another of equal or greater value, you have the option. The vacant land is adjacent. A parcel of vacant land can be included in the income tax exclusion, provided that it. to avoid capital gains tax on a land sale, consider these strategies:

From lessondbpalaeogene.z21.web.core.windows.net

30 Day Notice To Vacate Sample Letter Free Do I Have To Pay Taxes On The Sale Of Vacant Land The vacant land is adjacent. If you have held the land for one year or less before selling it,. capital gains on the sale of vacant land are taxable. to avoid capital gains tax on a land sale, consider these strategies: vacant land can qualify for the real estate capital gains tax exclusion, provided that: If you. Do I Have To Pay Taxes On The Sale Of Vacant Land.

From www.uslegalforms.com

Florida Vacant Land Contract 20202022 Fill and Sign Printable Do I Have To Pay Taxes On The Sale Of Vacant Land The vacant land is adjacent. 1) utilize a 1031 exchange to reinvest proceeds into similar. If you have held the land for one year or less before selling it,. capital gains on the sale of vacant land are taxable. A parcel of vacant land can be included in the income tax exclusion, provided that it. Some taxes can be. Do I Have To Pay Taxes On The Sale Of Vacant Land.

From handypdf.com

Vacant Land Contract of Sale Edit, Fill, Sign Online Handypdf Do I Have To Pay Taxes On The Sale Of Vacant Land sellers can wonder how to avoid capital gains taxes on land sale. If you have held the land for one year or less before selling it,. vacant land can qualify for the real estate capital gains tax exclusion, provided that: If you are planning to sell one property and purchase another of equal or greater value, you have. Do I Have To Pay Taxes On The Sale Of Vacant Land.

From dxovatakk.blob.core.windows.net

Vacant Land For Sale Kingston Area at Laverne Brown blog Do I Have To Pay Taxes On The Sale Of Vacant Land sellers can wonder how to avoid capital gains taxes on land sale. if you do sell your residence, then you may be able to exclude the land sale as part of the same sale (even if it. vacant land can qualify for the real estate capital gains tax exclusion, provided that: If you are planning to sell. Do I Have To Pay Taxes On The Sale Of Vacant Land.

From exoenscoe.blob.core.windows.net

Land For Sale Speaks Tx at Patricia Alexander blog Do I Have To Pay Taxes On The Sale Of Vacant Land if you do sell your residence, then you may be able to exclude the land sale as part of the same sale (even if it. A parcel of vacant land can be included in the income tax exclusion, provided that it. If you have held the land for one year or less before selling it,. 1) utilize a 1031. Do I Have To Pay Taxes On The Sale Of Vacant Land.

From www.pinterest.com

Signboard with land for sale text. Real estate concept. Land For Sale Do I Have To Pay Taxes On The Sale Of Vacant Land The vacant land is adjacent. 1) utilize a 1031 exchange to reinvest proceeds into similar. vacant land can qualify for the real estate capital gains tax exclusion, provided that: to avoid capital gains tax on a land sale, consider these strategies: income tax exclusion when selling land. sellers can wonder how to avoid capital gains taxes. Do I Have To Pay Taxes On The Sale Of Vacant Land.

From www.vrogue.co

Irs Form 8949 Instructions 2020 Fill Online Printable vrogue.co Do I Have To Pay Taxes On The Sale Of Vacant Land to avoid capital gains tax on a land sale, consider these strategies: A parcel of vacant land can be included in the income tax exclusion, provided that it. The vacant land is adjacent. vacant land can qualify for the real estate capital gains tax exclusion, provided that: Some taxes can be avoided with a 1031 exchange for a. Do I Have To Pay Taxes On The Sale Of Vacant Land.

From dxoqkqlfo.blob.core.windows.net

Vacant Lots For Sale Riverside Ca at Brant Child blog Do I Have To Pay Taxes On The Sale Of Vacant Land If you are planning to sell one property and purchase another of equal or greater value, you have the option. sellers can wonder how to avoid capital gains taxes on land sale. If you have held the land for one year or less before selling it,. The vacant land is adjacent. if you do sell your residence, then. Do I Have To Pay Taxes On The Sale Of Vacant Land.

From lessonlibrarytabefies.z13.web.core.windows.net

Sample Letter To Tell A Tenant To Move Out Do I Have To Pay Taxes On The Sale Of Vacant Land If you have held the land for one year or less before selling it,. income tax exclusion when selling land. 1) utilize a 1031 exchange to reinvest proceeds into similar. The vacant land is adjacent. Some taxes can be avoided with a 1031 exchange for a similar piece of land. vacant land can qualify for the real estate. Do I Have To Pay Taxes On The Sale Of Vacant Land.

From property-bill-of-sale-template.pdffiller.com

Bill Of Sale For Land Purchase Fill Online, Printable, Fillable Do I Have To Pay Taxes On The Sale Of Vacant Land If you are planning to sell one property and purchase another of equal or greater value, you have the option. A parcel of vacant land can be included in the income tax exclusion, provided that it. sellers can wonder how to avoid capital gains taxes on land sale. Some taxes can be avoided with a 1031 exchange for a. Do I Have To Pay Taxes On The Sale Of Vacant Land.

From watsonmortgages.com.au

Purchasing Vacant Land The Pros and Cons Watson Mortgages Do I Have To Pay Taxes On The Sale Of Vacant Land If you have held the land for one year or less before selling it,. If you are planning to sell one property and purchase another of equal or greater value, you have the option. Some taxes can be avoided with a 1031 exchange for a similar piece of land. income tax exclusion when selling land. if you do. Do I Have To Pay Taxes On The Sale Of Vacant Land.

From www.sampleforms.com

FREE 8+ Land Purchase Agreement Forms in PDF MS Word Do I Have To Pay Taxes On The Sale Of Vacant Land to avoid capital gains tax on a land sale, consider these strategies: If you have held the land for one year or less before selling it,. capital gains on the sale of vacant land are taxable. Some taxes can be avoided with a 1031 exchange for a similar piece of land. A parcel of vacant land can be. Do I Have To Pay Taxes On The Sale Of Vacant Land.

From wb-13-form-land-offer.pdffiller.com

20112021 Form WI WB13 Fill Online, Printable, Fillable, Blank pdfFiller Do I Have To Pay Taxes On The Sale Of Vacant Land income tax exclusion when selling land. The vacant land is adjacent. If you are planning to sell one property and purchase another of equal or greater value, you have the option. if you do sell your residence, then you may be able to exclude the land sale as part of the same sale (even if it. If you. Do I Have To Pay Taxes On The Sale Of Vacant Land.

From www.uslegalforms.com

VACANT LAND REAL ESTATE SALE AGREEMENT 2020 Fill and Sign Printable Do I Have To Pay Taxes On The Sale Of Vacant Land if you do sell your residence, then you may be able to exclude the land sale as part of the same sale (even if it. If you have held the land for one year or less before selling it,. The vacant land is adjacent. income tax exclusion when selling land. Some taxes can be avoided with a 1031. Do I Have To Pay Taxes On The Sale Of Vacant Land.

From www.signnow.com

Simple Land Sale Contract Complete with ease airSlate SignNow Do I Have To Pay Taxes On The Sale Of Vacant Land sellers can wonder how to avoid capital gains taxes on land sale. The vacant land is adjacent. If you are planning to sell one property and purchase another of equal or greater value, you have the option. to avoid capital gains tax on a land sale, consider these strategies: Some taxes can be avoided with a 1031 exchange. Do I Have To Pay Taxes On The Sale Of Vacant Land.

From www.sampleforms.com

FREE 8+ Land Purchase Agreement Forms in PDF MS Word Do I Have To Pay Taxes On The Sale Of Vacant Land If you have held the land for one year or less before selling it,. vacant land can qualify for the real estate capital gains tax exclusion, provided that: capital gains on the sale of vacant land are taxable. 1) utilize a 1031 exchange to reinvest proceeds into similar. A parcel of vacant land can be included in the. Do I Have To Pay Taxes On The Sale Of Vacant Land.

From www.sellland.com

5 Steps to Selling Land by Owner Sell Land Do I Have To Pay Taxes On The Sale Of Vacant Land Some taxes can be avoided with a 1031 exchange for a similar piece of land. 1) utilize a 1031 exchange to reinvest proceeds into similar. The vacant land is adjacent. capital gains on the sale of vacant land are taxable. A parcel of vacant land can be included in the income tax exclusion, provided that it. income tax. Do I Have To Pay Taxes On The Sale Of Vacant Land.

From www.vrogue.co

Buying Land For Sale In Queensland Know The Different vrogue.co Do I Have To Pay Taxes On The Sale Of Vacant Land A parcel of vacant land can be included in the income tax exclusion, provided that it. vacant land can qualify for the real estate capital gains tax exclusion, provided that: The vacant land is adjacent. sellers can wonder how to avoid capital gains taxes on land sale. capital gains on the sale of vacant land are taxable.. Do I Have To Pay Taxes On The Sale Of Vacant Land.